As a B2B fitness equipment manufacturer, we at Leadman Fitness understand that trade policies can dramatically shift the landscape for procurement and pricing. One of the most talked-about topics right now in the business community is the 2025 U.S. tariff increase, which is having a direct impact on the importation of commercial fitness equipment. But first — what is a tariff?

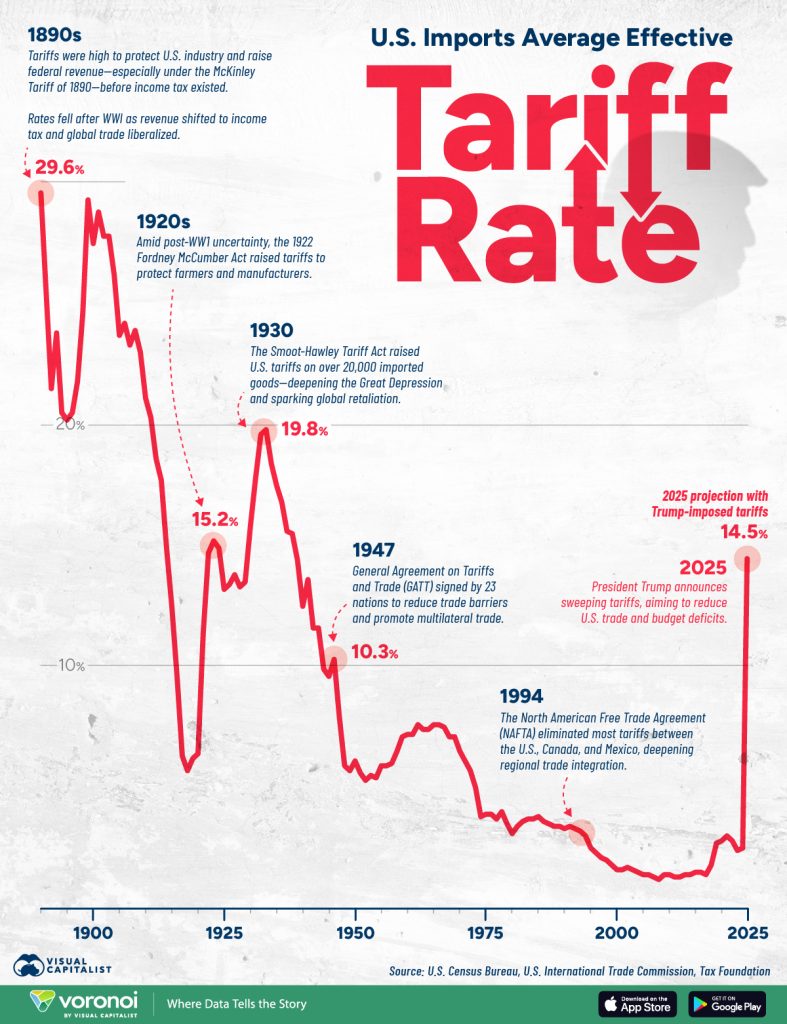

In simple terms, a tariff is a government-imposed tax on imported goods. The tariff definition often used in trade policy discussions is: a duty or tax levied by a country on goods and services imported from other nations, usually to protect domestic industries or respond to foreign trade practices. Over the past few years, these duties have played an increasingly prominent role in U.S. trade strategy — particularly since the implementation of the Trump tariffs, which marked a turning point in U.S. global trade relationships and set the stage for the higher tariffs now affecting multiple industries, including fitness equipment.

In this article, we’ll break down what these 2025 tariff changes mean for our industry, how they affect buyers of commercial gym equipment, and how B2B customers can respond strategically. We’ll also explore the state-level tax incentives and subsidy options that can help offset costs, especially for large-scale buyers in sectors like hospitality, education, and commercial real estate.

Overview of the U.S. Tariff Increase in 2025

In April 2025, the U.S. implemented a new round of tariff increases, with fitness equipment imports being among the affected categories. This is part of a broader economic policy aimed at protecting domestic manufacturing and reducing dependency on imports.

The average effective tariff rate now sits at 22.5% — the highest it’s been since 1909 — affecting a wide range of products, including:

- Dumbbells

- Kettlebells

- Barbells

- Weight Machines

- Bumper Plates

Most of these products are typically sourced from manufacturing hubs in Asia, including China, Vietnam, and Taiwan — all of which now face stricter trade terms. These new tariffs mean increased costs not only for end users, but also for distributors, retailers, and project developers across the U.S.

How Tariffs Affect the Commercial Fitness Equipment Market

The impact of tariffs on the commercial fitness equipment market extends far beyond simple cost increases. These changes ripple through every stage of the supply chain, affecting manufacturers, distributors, and end-users alike.

In the fitness industry — especially the commercial segment — buyers typically plan large-scale purchases for gyms, training centers, hotels, schools, and wellness centers. These buyers operate on tight budgets and strict timelines. Tariffs, however, introduce sudden and unpredictable cost escalations, often without sufficient notice, forcing companies to reassess entire procurement strategies.

Moreover, tariffs can distort competitive dynamics. U.S.-based fitness brands may see an advantage over importers, but they too rely on global parts and materials — meaning tariff pressure can still raise domestic prices. Distributors who depend on imports may need to absorb losses or pass costs onto customers, damaging long-term relationships.

Lead times are also affected. Customs inspections become stricter, documentation becomes more complex, and port congestion may increase. These logistics disruptions can delay gym openings or renovations, leading to revenue losses and operational headaches.

In short, tariffs are not just a financial issue — they create strategic, operational, and timing risks across the entire fitness equipment supply chain.

Who Is Most Affected?

The tariff hikes disproportionately affect commercial buyers and service providers who rely heavily on imported fitness equipment. Here’s a deeper look at who’s feeling the impact:

- Commercial Gyms and Franchises

Purchasing equipment in bulk is standard. Tariff-induced price hikes on essentials like barbells and dumbbells could increase total project costs by 15–30%, limiting expansion or renovation projects. - Hospitality and Real Estate Developers

Hotels and apartment buildings use premium gyms to attract clients. Increased costs reduce ROI and can delay grand openings. - Public Sector and Educational Institutions

With limited budgets and lengthy procurement cycles, these organizations may postpone necessary equipment upgrades or fail to meet athletic program needs. - Fitness Equipment Resellers and Distributors

Many resellers source inventory from tariff-affected countries. They’re now forced to either raise prices or accept slimmer profit margins — both unsustainable long-term.

In essence, those who rely on consistency and scalability in procurement — and who operate in cost-sensitive sectors — are hit the hardest.

How B2B Buyers Can Respond to the Tariff Changes

Despite these challenges, B2B buyers are not powerless. With the right strategies and supplier relationships, it’s possible to minimize the financial impact and even gain a competitive edge during turbulent trade periods.

- Plan and Order in Advance

Working ahead of procurement schedules can help buyers avoid sudden cost spikes. At Leadman Fitness, many U.S. clients are now booking equipment 3–6 months in advance to lock in favorable pricing. - Consolidate and Optimize Shipments

Larger, consolidated shipments can reduce per-unit shipping and customs costs. We help buyers manage batch production and optimize container loads. - Explore Alternative Supply Routes or Origin Countries

In some cases, components can be sourced from countries with lower tariffs. We maintain flexible sourcing and supply chain options to help mitigate tariff exposure. - Leverage Manufacturer Incentives

As a direct manufacturer, we regularly offer custom packages, price breaks, and freight incentives to help our customers manage costs during volatile periods. - Consult Tax Professionals on State Incentives

Several U.S. states offer subsidies or exemptions that can reduce the overall cost burden. Staying informed can result in substantial savings.

Ultimately, the best strategy is not to pause — but to adapt smartly and partner wisely.

Why Choose a Direct Manufacturer (Like Us) in Times Like This

At Leadman Fitness, we understand the difficulties commercial buyers face in today’s trade environment. That’s why we position ourselves as a strategic partner — not just a supplier.

Here’s why working directly with us can make a difference:

- Cost Efficiency

No middlemen. No inflated distributor margins. Our factory-direct model allows us to keep pricing competitive — even with tariffs in play. - Customization & Flexibility

Whether it’s adjusting product specs or packaging for efficiency, we tailor solutions to your project’s unique needs. - Fast, Transparent Logistics

We’ve built a robust international logistics system to ensure timely delivery and full customs documentation — minimizing surprises at the port. - Expert Support

Our team knows the U.S. market inside and out. From spec selection to freight advice, we’re here to help you make the smartest decisions.

Analysis of Tariff Subsidy Policies of Various States in the U.S.

To help offset the impact of federal tariffs, some states offer subsidy programs, sales tax exemptions, or energy-efficiency incentives. Here are a few examples relevant to fitness equipment:

- Texas – Manufacturing Equipment Exemption

Fitness equipment used in manufacturing or production environments may qualify for sales tax exemptions.

→ Official Texas Comptroller Guide – Exemptions - Texas – ENERGY STAR Tax Holiday

The state runs an annual sales tax holiday for energy-efficient appliances and equipment. While primarily for consumers, this can apply to certain fitness-related products.

→ Texas Energy Tax Info - Other States

Some states, like New York and California, offer green building incentives that may cover gym equipment used in LEED-certified or wellness-centric construction.

We encourage buyers to consult with local accountants or tax experts to determine eligibility and maximize savings.

The 2025 tariff increases present real challenges — but they also open up new opportunities for companies who act strategically. At Leadman Fitness, we’re here to support your goals with cost-effective, customizable, and reliable fitness equipment solutions, backed by industry expertise and global logistics experience.

Let’s work together to navigate this landscape — and grow stronger through it.

Contact us today to discuss your needs, request a quote, or explore custom solutions tailored to your business.

Frequently Asked Questions

As of 2025, the average rate is around 22.5%, though it varies based on country of origin and product category.

Consider bulk orders, early planning, alternative sourcing countries, and working directly with manufacturers like us to access customized solutions.

Yes. Some states offer sales tax exemptions or incentives for specific equipment types. Always check with local tax authorities.

Welcome! I’m Jordan Mitchell, the dedicated editor at Leadman Fitness, where we specialize in manufacturing high-quality bumper plates, barbells, weight machines, kettlebells, and dumbbells. With a passion for fitness and a keen eye for detail, I ensure that our product information is clear, accurate, and engaging for our customers. My role involves collaborating closely with our design and production teams to highlight the innovative features and superior craftsmanship that set Leadman Fitness apart in the industry. Whether you’re a professional athlete or a fitness enthusiast, I’m here to provide you with the information you need to achieve your training goals with our top-of-the-line equipment.